How to Spend HSA Funds: 5 Unique Ideas

Article at a Glance

- Tens of millions of Americans use Health Savings Accounts to access healthcare at tax advantaged rates.

- Not every product or service associated with healthcare is covered by HSA plans.

- Careful research paired with sound advice from a tax professional can reveal unique ways to put HSA funds to good use.

Contents

It blew my mind to learn recently that Health Savings Account assets grew to nearly $147 billion across more than 39 million accounts in 2024.

I know some friends who work in bigger corporate jobs whose employers contribute to HSAs, but wasn’t aware of the sheer number of individuals who fund these accounts. When I dug in and learned more about the tax and savings advantages of HSAs, it all made sense.

Especially towards the end of the year, we get asked by customers if we accept Flexible Savings Account (FSA) and Health Savings Account (HSA) payments at Gene Food. The good news, is yes, we do (although consult with your tax experts please), and a growing number of our user base chooses to use HSA funds to get started with a personalized nutrition plan using our algorithm.

Pro tip: even if your HSA card is declined at an HSA eligible business, customer service can often provide an itemized receipt after purchase that will allow for reimbursement.

However, Gene Food isn’t the only way to put your HSA dollars to maximum value, here are five ideas for using your HSA card in a way that lives up to the spirit of the name Health Savings.

Also note that, in some cases, thinking ahead and getting a “letter of medical necessity” from your doctor can unlock products and services that would be otherwise be off limits with HSA funds.

HSA Approval Quick Guide

| Expense | Approved | Usually Not Approved |

|---|---|---|

| Doctor visits | Copays, deductibles, specialist visits | Plastic surgery deemed elective |

| Dental | Cleaning, fillings, braces | Whitening |

| OTC | Pain relievers, allergy meds, cold medicine (since CARES Act) | Most dietary supplements |

| Devices | Blood pressure monitors | Fitness trackers |

| Reproductive | Fertility treatments | Baby formula |

| Cutting Edge | Gene Food, Function Health, Viome | Massage, Spa |

#1. Gene Food

Hey, you are on the Gene Food blog, so you knew we would suggest our own product, right?

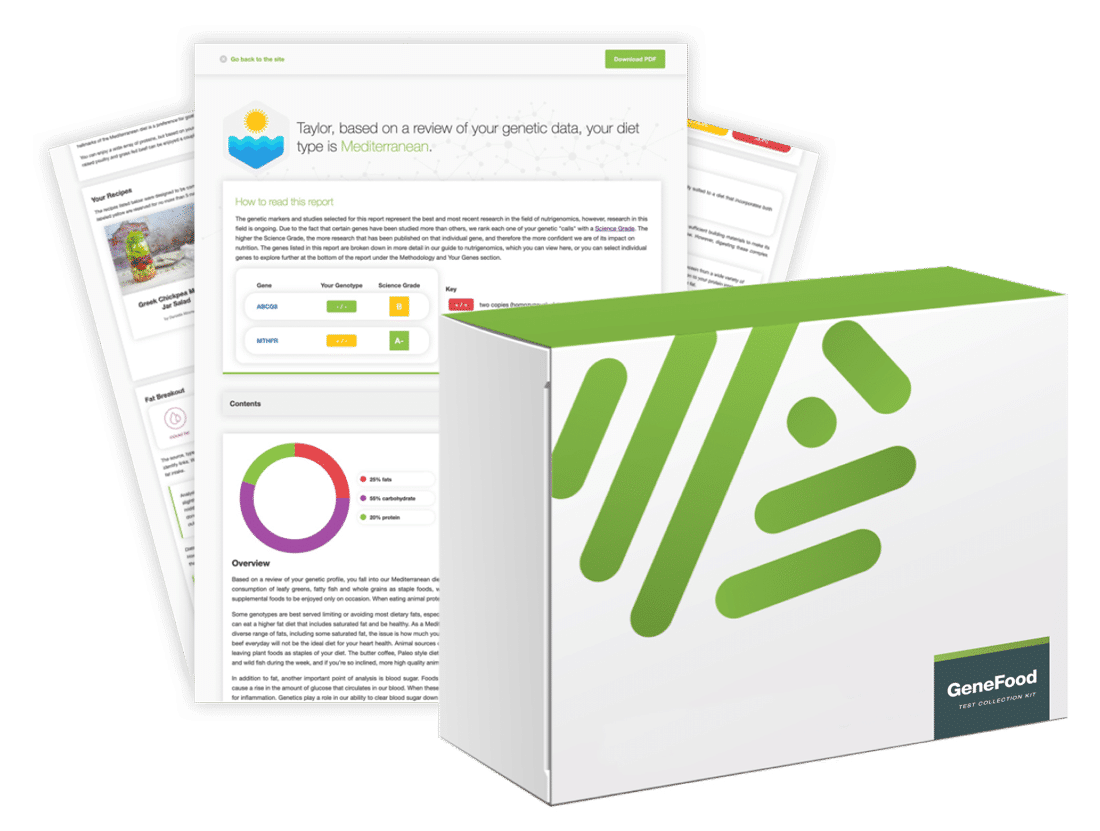

I started Gene Food as a personal passion project after falling on the wrong side of my health in NYC and finding nothing but conflicting diet information when researching online. Gene Food has been in business since 2018 and offers a unique approach to personalized nutrition with our proprietary diet type algorithm. Our software scores users into one of twenty diet types based on a series of polygenic risk scores, which look at saturated fat metabolism, carbohydrate metabolism, histamine, protein, lactose, ability to achieve ketosis, and more.

Get Started With Personalized Nutrition

Gene Food uses a proprietary algorithm to divide people into one of twenty diet types based on genetics. We score for cholesterol and sterol hyperabsorption, MTHFR status, histamine clearance, carbohydrate tolerance, and more. Where do you fit?

Gene Food is designed to be used in tandem with your physician and the “deeper health insights” we offer through our reporting has been deemed a qualified medical expense by the IRS. As always consult with your own tax advisor before purchasing.

#2. Acupuncture

Alternative therapies, like acupuncture, are recognized as HSA eligible when used to treat a medical condition, rather than just for overall wellness.

As I mention in my Gene Food bio, Mia Barbrick, a healer and acupuncturist based out of Laguna Beach, is one of my health mentors, and one of the people I admire most in life. I have seen firsthand how powerful acupuncture can be as a modality when the right practitioner is involved. In addition to Mia, I can also recommend Dr. Ziyang Zhou in Austin for any readers in the Texas Hill Country area.

#3. Oura Ring

I became a Dad later in life, which is more common in today’s world. The “fertility issue” has only grown as more couples delay the decision to start a family.

If you and your partner are planning on having a family sometime soon, ovulation kits, sperm analysis, pregnancy tests, and even IVF treatments are all eligible under your HSA plan, but you probably kew that already.

Now, the title of this blog post is “Unique Ideas for Spending HSA Funds,” and to that end, here is an outside the box suggestion for anyone interested in fertility, but also optimizing sleep – an Oura Ring. I’ve had a love/hate relationship with my Oura Rings in the past, but the technology continues to evolve and the team at Oura has built some really impressive fertility tracking tools into the app, which is part of the reason the device is now HSA eligible.

#4. Baby Gates & Baby Proofing

Continuing with the baby theme, one of the sneaky expenses for new parents is all the equipment you have to buy for a new baby. If you live in a house that has two stories, or even a basement, baby gates will be a must buy, and the cost can add up the more stairwells you have. This type of gear, because it’s deemed essential to the health of a new baby, is HSA eligible. While you’re at it, add outlet covers and cabinet locks.

Breast pumps, baby sunscreen, and thermometers are also all eligible. Babies are expensive so maximizing use of HSA funds to take care of the essential items is a smart strategy.

#5. Ketone Test Strips

A recently published study shows the ketogenic diet, when it corresponds with elevated LDL-C, is more harmful than we previously realized.

Ketogenic diets, which are defined as ultra low carbohydrate diets that usually include less than 50 grams of carbohydrates per day, are widely adopted, but rarely implemented properly (or safely).

We have written quite a bit on the blog about why ketogenic diets don’t work for many people who try them and why it’s advisable to avoid “internet keto,” which is a style of eating that is ultra high fat without achieving a state of ketosis, which is the purpose behind keto diets in the first place, usually to treat epilepsy. However, there are physicians, like Dr. Ethan Weiss, who I cite below, who still advocate for the benefits of low carb diets, but only when lipid numbers are taken seriously.

So, with those caveats out of the way, for those readers who are on responsible ketogenic diets where LDL-C stays in range, keto test strips are fully eligible for HSA payments and are an essential tool for measuring the success of this style of eating.

Final thoughts

HSA accounts are an important tool for the millions of Americans who carry high deductible health insurance, and there are creative ways to use the funds that comply with IRS guidelines (although it is always essential to check first with your CPA).

I hope this list gave you some ideas you can use to utilize your HSA account in ways that’ll maximize your health and your family’s health this year and in the years to come. For more ideas, check out the HSA store, an online retailer specializing in HSA eligible products.